BizNpersonalfinance :Investing in Indian Equity? Brace yourself !

Investing in Indian Stock markets is not a game for the feeble mind. It can be gut wrenching stuff with the market yo-yo-ing wildly from anywhere from 100 points (almost std. stuff now) to 500 points (day before).

I started investing almost 2 years ago when the market was 4000 odd points to 6000 points. Naturally, I have made a sizeable amount - alas on paper! Greed knoweth no boundaries and I have held on tight amidst the wild gyrations of the Sensex and the Nifty. So far so good ! Today the market rose by 190 points. Tomorrows another day though and who knows what's in store?

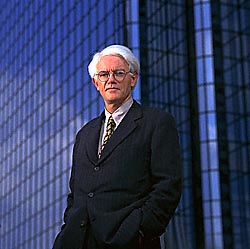

My personal favorite investment guru is Marc Faber. For sheer color of personality you cannot beat this guy. Faber is a legend amongst investors for the range and depth of his knowledge on Investing and Economics.  Check out his website at www.gloomboomdoom.com. His investment newsletter is subscribed far and wide and teaches you something new everytime you read another article of his (the market comments section on his website is free unlike the newsletter). Faber is very bearish on the U.S economy (not for nothing does he have the moniker ' Dr. Doom') but bullish on the LONG TERM future of the Indian economy.

Check out his website at www.gloomboomdoom.com. His investment newsletter is subscribed far and wide and teaches you something new everytime you read another article of his (the market comments section on his website is free unlike the newsletter). Faber is very bearish on the U.S economy (not for nothing does he have the moniker ' Dr. Doom') but bullish on the LONG TERM future of the Indian economy.

Faber had predicted a rise in the prices of commodities and in particular precious metals, long before the present bull run in that

quarter. Interesting Faber's not a Investment geek who believes only in Stock Research on Super Computers. He believes that reading more than anything else (and more importantly- understanding) a wide range of subjects (and how they affect Economics of various Asset Classes) is essential to invest wisely. He himself invests 3-4 hours every day on reading !

Another favorite of mine is Peter Lynch. His books - 'Beating wall street','One up on Wall Street' and 'Learn to Earn' are must reads for any wannabe investor. Lynch retired in his 40's, at the peak of his career,  leaving many a investor dissappointed. But Lynch, as ever, was clear that he wanted to give time to his family and personal life, after managing fortunes for almost two decades.

leaving many a investor dissappointed. But Lynch, as ever, was clear that he wanted to give time to his family and personal life, after managing fortunes for almost two decades.

That said, reading stuff written by these investment greats does not a great investor make. As I have discovered myself, investing requires temperament of the highest order. AND NOBODY EVER TAUGHT ANYONE TO HAVE SELF BELIEF!

One person I know who has abundant of these traits lives 200 meters from where I stay and is closely related. He is a 70 yr old gentleman, almost chained to his house and bed, due to a rare disease, and who makes more money out of investing in equity than many a successful executive. But that's a story for another day and another day and another time,if at all !